- Air MUS12 Jordan 3LAB5 Gamma Blue Metallic Silver - MUS12 Jordan Air 200e Men Dc9836-200 - 200 - MUS12 Jordan Air 200e Men Dc9836

- Nike air jordan max 13 hologram Bred Black Red 2019 Release Date , air jordan max 1 rebel chicago white varsity red black , IetpShops

- 200 Release Date - nike gold air chukka moc high school - SBD - nike gold air yeezy glow in the dark sneakers boys Rattan Obsidian CZ4149

- Sneakers Draked Viola

- AspennigeriaShops , 5 Best Adidas Classic Trainers in 2024 , jam tangan adidas sport original

- air force 1 shadow

- Usher Air Jordan 11 Gold Sample

- 554725 113 air jordan 1 mid white black 2020 for sale

- air jordan spring 2021 retro collection release date info

- kids air jordan

- Home

- News and analysis

- Info hubs

- Events

- Video

- Case Studies

- About us

- Magazine

- Advertising

Produced for the industry by the Association for Consultancy and Engineering

News

Lack of major projects blamed for slow start to the year for construction

A lack of investment in major projects continues to stunt progress in the construction sector, with new contracts 10.6% lower than this time last year, at a value of £5.4bn.

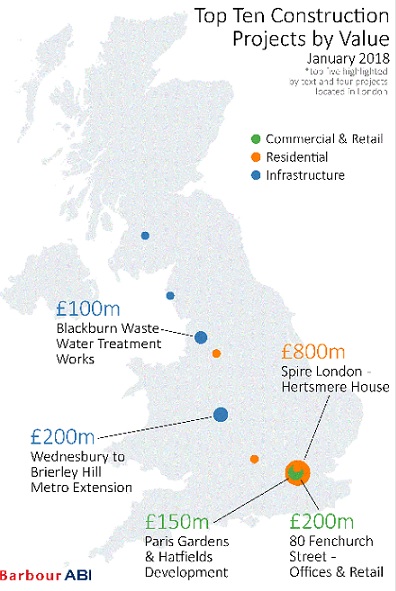

According to the latest Economic & Construction Market Review from industry analysts Barbour ABI, residential housing developments and infrastructure both dominated the construction sector across January, which combined, contributed to more than 65% of the total value of construction in the month. The largest project in January has been highlighted as the £800m Spire London Hertsmere House development at West India Quay in London, more than four times larger than the next biggest development.

Eight of the biggest ten projects in January came from the residential housing or infrastructure sector. These included the £200m Wednesbury to Brierley Hill Metro Extension and the £100m Waste Water Treatment Works in Blackburn.

Commenting on the figures, Michael Dall, lead economist at Barbour ABI, said: “The recent collapse of Carillion has not done much for confidence in the sector, which is already facing a number of headwinds. Mainly due to a lack of major projects, construction has been held back in January. Nevertheless, encouraging figures from the residential housing and infrastructure sector is pleasing, but other sectors now need to help pick up the slack, such as hotel, leisure & sport which produced its lowest figures in January since October 2015.”

Unsurprisingly, London led the way when it came to major project investment. Contract award values in the capital were 32% of the UK total, with the West India Quay development playing a big role. London was ahead of Manchester and Scotland with 13% and 11% of the share respectively.

A concerning element of the analyst’s findings was the fact education and hotel, leisure and sport sectors all saw monthly decreases in January, which the industry should expect to rise slightly after a traditionally quiet December. The remaining sectors of residential housing, infrastructure, commercial and retail, industrial and medical and health all saw increases on the previous month but overall below the levels of January 2017.

Today’s findings come after last month’s analysis from Barbour ABI which showed how embedded Carillion were in the construction industry. Data revealed they were the main contractor on almost 60 schemes worth a total value of £5.7bn, and that is without any calculation of the other jobs they were involved in.