- Пилинг - диски с bha и pha - кислотами needly daily toner pad 1шт — цена 50 грн в каталоге Скрабы для лица ✓ Купить товары для красоты и здоровья по доступной цене на Шафе , Украина #112548157

- Super Max Perfect Air Jordan 5 Women

- 200 Release Date - nike gold air chukka moc high school - SBD - nike gold air yeezy glow in the dark sneakers boys Rattan Obsidian CZ4149

- air jordan 6 carmine 2021 release date

- nike sb dunk sizing and fit guide

- nike air force 1 low white gold dc2181 100 release date info

- Air Jordan 1 University Blue 555088 134 Release Date Price 4

- air jordan 4 white tech grey black fire red ct8527 100 release date

- nike air force 1 boot cordura black wheat university gold do6702 001

- Nike Blazer Mid 77 Catechu DC9265 101 Release Date

- Home

- News and analysis

- Info hubs

- Events

- Video

- Case Studies

- About us

- Magazine

- Advertising

Produced for the industry by the Association for Consultancy and Engineering

Analysis

Electricity – we're having the wrong conversation

The debate surrounding the costs of energy generation in Britain is all wrong – we should all be prepared to pay more for electricity, says Acumen7 advisor, Peter Dixon.

Recent controversy surrounding the on-off and now confirmed decision on Hinkley Point C has exposed a number of myths about the electricity market. In particular, there are three: that nuclear is too expensive; that CCGTs (combined coal and gas turbines) are cheapest and secure; and that there are no other alternatives.

The current debate surrounding these myths is focused upon the wrong issues.

Evidence available indicates that the wholesale price of electricity in no way represents the price necessary to encourage investment. Hence, the energy market as a whole is a failure. We should all be prepared to pay a lot more for electricity. Here are some facts to enable more reasoned discussion:

Nuclear is too expensive?

This chart taken from data provided by the petrochemical information provider ICIS shows that the current wholesale price of electricity is around £40/MWh.

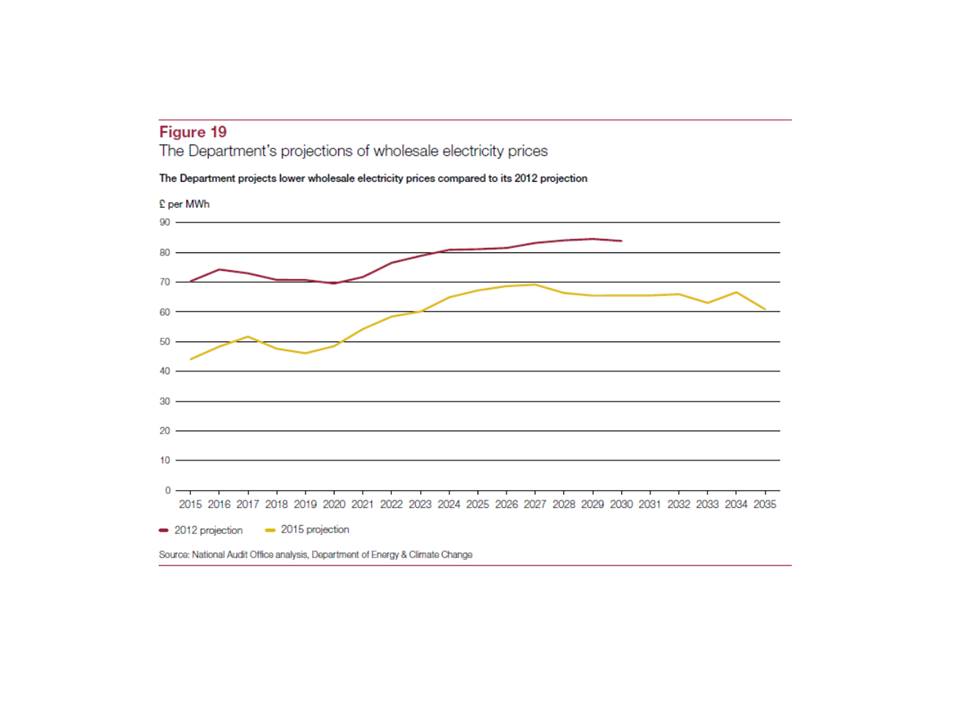

The recent National Audit office report ‘Nuclear power in the UK’ shows government’s projections of future wholesale prices of electricity:

The forecast may or may not be realistic – Ofgem comments in its 2015 Wholesale Market Report: “The growing penetration of renewable energy sources is also having an increasingly significant effect on wholesale electricity prices. Renewable energy sources, like wind in the case of GB, have very low marginal costs (zero fuel costs). They also receive subsidies when they generate. This means electricity generated from wind effectively displaces other power stations which have higher marginal costs. This has the effect of reducing the price of electricity in the wholesale market as the more expensive plant are no longer required to run when the wind is blowing. As renewables continue to contribute more to the generation mix, we expect that the impact this has on the wholesale price will increase. In Germany, where renewables already play a larger role in the generation mix than in GB, wholesale electricity prices are now highly correlated with the volume of wind and solar output.”

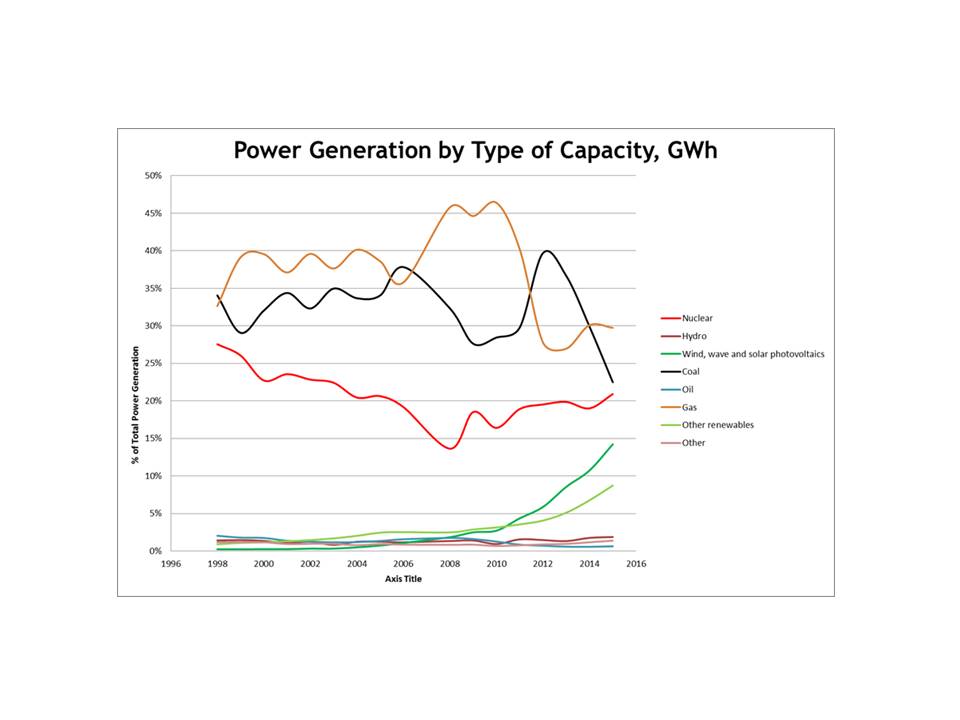

But this is not the whole story of the wholesale price. Coal stations are being closed and while the nuclear fleet continues to generate, both of these sources are old and mostly fully depreciated. The chart below from government data shows the picture over time:

The consequence is that wholesale electricity prices are basically covering nuclear, CCGT and coal variable costs and no more. This price level is insufficient to entice investment in any type of capacity except renewables which have a guaranteed price, and as Ofgem says, a zero marginal cost.

As widely reported, National Grid’s capacity margin is at all time low levels. But, as website New Power reports: “The results (of the Capacity Market Auction) highlight the lack of progress in bringing new gas-fired plant into operation. EDF’s permission (for a CCGT) brings to 20 the number of gas-fired projects with planning consent in Great Britain that have not entered the construction phase, according to New Power’s database. Some have had planning permission for years and in at least one case it has lapsed, despite the fact that the GB supply/demand margin has been narrowing over the past half-decade.”

So, if no new CCGT capacity is entering the market, then the ‘price’ of electricity must by definition be ‘too low’. Even CCGTs are ‘too expensive’.

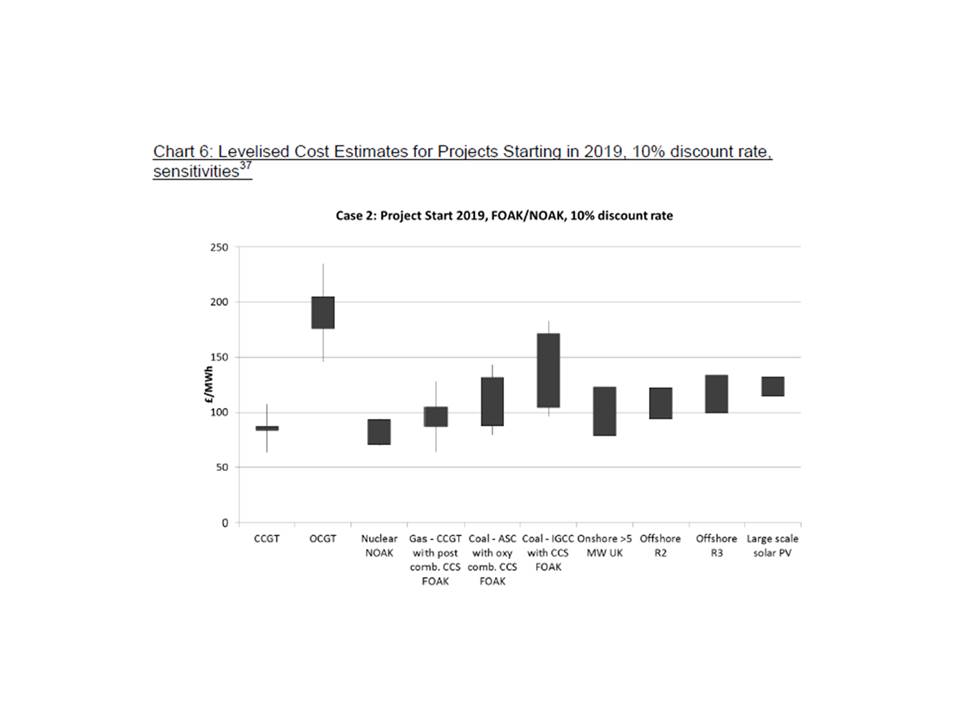

So what are the costs of new generation capacity? The now defunct Department of Energy and Climate Change published an authoritative study of new build generation capacity in 2013, and there is little reason to think that the conclusions will have altered significantly over the last couple of years.

The chart below taken from ‘Electricity Generation Costs 2013’ shows ranges of costs for various types of capacity. These costs are expressed as Levelised Costs per Megawatt Hour (MWh), since this serves to compare costs supposedly on a level playing field:

As can be seen, the estimated central costs of new build CCGTs are around the same as the costs of nuclear at £80/MWh. Now, the comparison is then often made with the Contract for Difference Strike Price of £92.50/MWh (2012 money) for EdF’s Hinkley Point C agreed by DECC – but note that Hinkley Point C is First of a Kind (FOAK) and that the EdF deal also specifies that if a second or more stations are built, then the Strike Price will drop to £89.50.

So, nuclear is ‘too expensive’? But relative to what? Commentators who have not taken the trouble to think about the economics of this market blithely say that CCGTs are cheapest and secure. Are they?

CCGTs are the cheapest and are secure?

The DECC chart indicates that CCGT costs are close to nuclear. However, the thin lines above and below the main bar also show that the costs of CCGTs are very sensitive to gas costs. We all know that gas (and oil) prices are highly volatile. Currently they are very low, so CCGT costs are going to appear to be about £60/MWh.

But if, or rather when, we return to higher gas cost levels, they could appear to be about £100-£110/MWh, rather higher than nuclear, and level or higher than wind. In addition, the government talks of the Energy Trilemma, of which security of supply is one arm. Gas prices are internationally determined, so what happens if Russia decides that gas supply can be used as leverage in international relations? Even with fracking, there will be substantial price effects.

The DECC report states that using Levelised Cost of Electricity Generation gives an unbiased comparison between types of capacity. As used by DECC, it does not. This is what the report has to say:

“The Levelised Cost of Electricity Generation is the discounted lifetime cost of ownership and use of a generation asset, converted into an equivalent unit of cost of generation in £/MWh. The levelised cost of a particular generation technology is the ratio of the total costs of a generic plant (including both capital and operating costs), to the total amount of electricity expected to be generated over the plant’s lifetime. Both are expressed in net present value terms. This means that future costs and outputs are discounted, when compared to costs and outputs today. This is sometimes called a life cycle cost, which emphasises the “cradle to grave” aspect of the definition. The levelised cost estimates do not consider revenue streams available to generators.

As the definition of levelised costs relates only to those costs accruing to the owner or operator of the generation asset, it does not cover wider costs that may in part fall to others, such as the full cost of system balancing and network investment, or air quality impacts. The levelised cost measure does not explicitly include the financing costs attached to new generating stations. In most cases, this report includes estimates using a standard 10% discount rate across all technologies, in line with the ‘tradition’ used in reports produced by other organisations. These estimates allow estimates to be viewed as neutral in financing and risk terms when comparison is made across technologies.”

Anyone in the infrastructure business is likely to be more than familiar with discounted cash flow analysis. It does not need a genius to work out that a high discount rate (such as the 10% used by DECC – claiming ‘tradition’) will penalise investments with a long asset life. So, nuclear with a longer life than CCGT will appear to be ‘more expensive’. This is a point made also by Tidal Lagoon Power about its proposed Swansea Bay project. There is an important discussion to be had around what discount rate should be used, but it is clear that that rate is not 10%.

From an investor’s perspective, then the investor’s cost of capital for the level of risk is appropriate – probably around 6% in real terms. From a social investment perspective (as used by government in assessing social projects), then around 2-3% is probably appropriate; all of which raises questions about the value of electricity generation to the country as a whole, and opens up a new debate around financing of projects, which can be pursued elsewhere.

There are no other alternatives?

Meanwhile, National Grid has been creating scenarios of future demand and supply of electricity. These suggest that the future of UK generation is nothing like today’s. Foreseeing the closure of all coal capacity, National Grid envisages a future of significant increases in renewables (wind and solar mostly), a surge in inter-connection capacity and a steady increase for ‘Fossil Fuel’ which is code for CCGTs.

Besides the predicted increase in solar capacity (bringing the same ‘environmental’ issues as on-shore wind?), the rise in inter-connection capacity signals a belief that reliable or secure electricity capacity is readily available outside the UK at a competitive price, once the costs of the connection are taken into account. In public discussion, these issues have not yet significantly surfaced, but certainly should.

Conclusion: We will all pay more for electricity

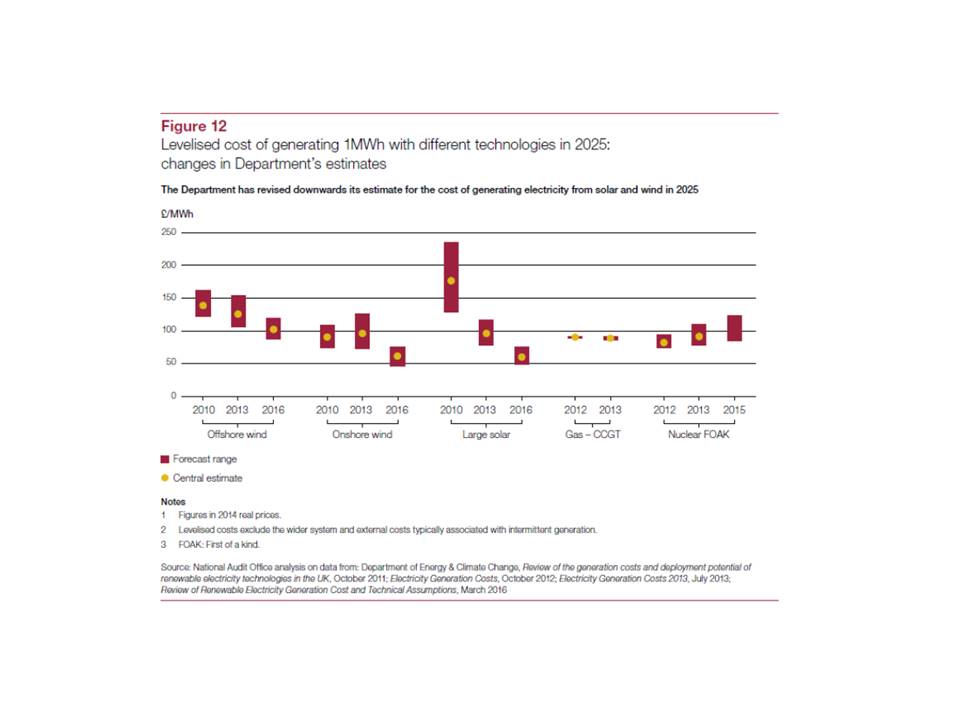

The recent report by the National Audit Office (using DECC data) effectively supports these contentions. This chart from the report shows the latest estimates for generation costs:

Again, we see that none of the generating costs except for on-shore wind (not politically popular) and large solar (possibly not politically popular) are close to the current or expected wholesale price, so any new investment will need some form of support, even CCGTs. Thus the estimation of net subsidies required by Hinkley Point C (and indeed all other forms of subsidised generation) are extremely misleading since they take as a basis the difference between a full investment cost and a wholesale price which is not driven by re-investment costs.

One can only conclude that we will all need to pay much more for electricity and that the government will need either to redesign the whole market operation or find mechanisms to support all future investment.